Vancouver’s Bench Accounting abruptly shuts down, with 606 – a shocking event that sent ripples through Vancouver’s business community. The sudden closure left clients scrambling, employees facing unemployment, and creditors wondering about outstanding debts. This unexpected downfall raises questions about the firm’s financial health, potential regulatory issues, and the broader implications for the city’s economic landscape. We’ll explore the immediate consequences, investigate potential causes, and examine the legal and regulatory ramifications of this significant event.

The number 606 remains a mystery, its significance yet to be fully understood. Was it a code, a financial indicator, or simply a coincidental detail? We’ll delve into possible explanations, examining financial difficulties, potential legal issues, and the impact of economic downturns. The closure serves as a stark reminder of the fragility of even seemingly stable businesses and highlights the importance of robust risk management strategies.

So, Vancouver’s Bench Accounting just closed its doors – a real bummer, especially with the 606 investigation looming. It’s a wild contrast to the drama down under, where, as you can read in this article, Strikers fume after on-field umpire helps Hobart Hurricanes avoid a close call. Anyway, back to Vancouver’s Bench Accounting; the whole situation leaves a lot of questions unanswered.

Vancouver’s Bench Accounting Abrupt Shutdown

The sudden closure of Bench Accounting in Vancouver, leaving 606 affected, sent shockwaves through the city’s business community. This event highlights the fragility of even seemingly stable businesses and raises critical questions about regulatory oversight, risk management, and the impact on clients, employees, and creditors.

The Immediate Impact of Bench Accounting’s Closure

The abrupt shutdown left clients scrambling to secure their financial records and find new accounting services. The potential financial repercussions for affected businesses are significant, ranging from delayed tax filings and audits to difficulty accessing crucial financial information. Employees faced immediate job loss and the uncertainty of finding new employment, impacting their livelihoods and financial stability.

| Stakeholder | Short-Term Effects | Long-Term Effects |

|---|---|---|

| Clients | Loss of access to financial records, potential delays in tax filings, disruption of business operations. | Difficulty obtaining loans, potential legal battles to recover assets, damaged business reputation. |

| Employees | Job loss, immediate financial hardship, difficulty finding new employment. | Long-term unemployment, career disruption, potential skill degradation. |

| Creditors | Difficulty recovering outstanding debts, potential write-offs. | Financial losses, potential legal action against the company’s assets. |

Investigating the Reasons Behind the Closure

Several factors could have contributed to Bench Accounting’s unexpected closure. Financial difficulties, perhaps stemming from an economic downturn or industry-specific challenges, are a likely possibility. Legal issues, such as lawsuits or regulatory violations, or internal conflicts within the company, could also have played a role. The significance of the number ‘606’ remains unclear without further information; it might refer to a specific account, transaction, or internal code.

A hypothetical timeline might include:

- Increasing financial strain over several quarters.

- Failed attempts to secure additional funding or restructure debt.

- Escalating legal or internal conflicts.

- Sudden cessation of operations and communication with clients and employees.

Analyzing the Regulatory and Legal Ramifications, Vancouver’s Bench Accounting abruptly shuts down, with 606

Regulatory bodies such as the Chartered Professional Accountants of British Columbia (CPABC) and the relevant provincial authorities will likely investigate the closure. Clients can pursue legal action to recover assets or information, potentially through civil lawsuits. The company’s directors and officers may face legal consequences if negligence or misconduct is discovered.

So, Vancouver’s Bench Accounting suddenly closed its doors, leaving a lot of people wondering what happened with that 606 thing. It’s a bit like the shock some viewers felt when watching the new BBC show; check out this article about it, BBC Beyond Paradise fans say the same thing minutes into , to see what I mean. The unexpected twists and turns are similar in both situations, leaving audiences reeling.

Anyway, back to Bench Accounting – the mystery continues!

- Civil lawsuits by clients for negligence or breach of contract.

- Investigations by regulatory bodies into accounting practices and compliance.

- Potential legal action by creditors to recover outstanding debts.

- Criminal investigations if fraud or other illegal activities are suspected.

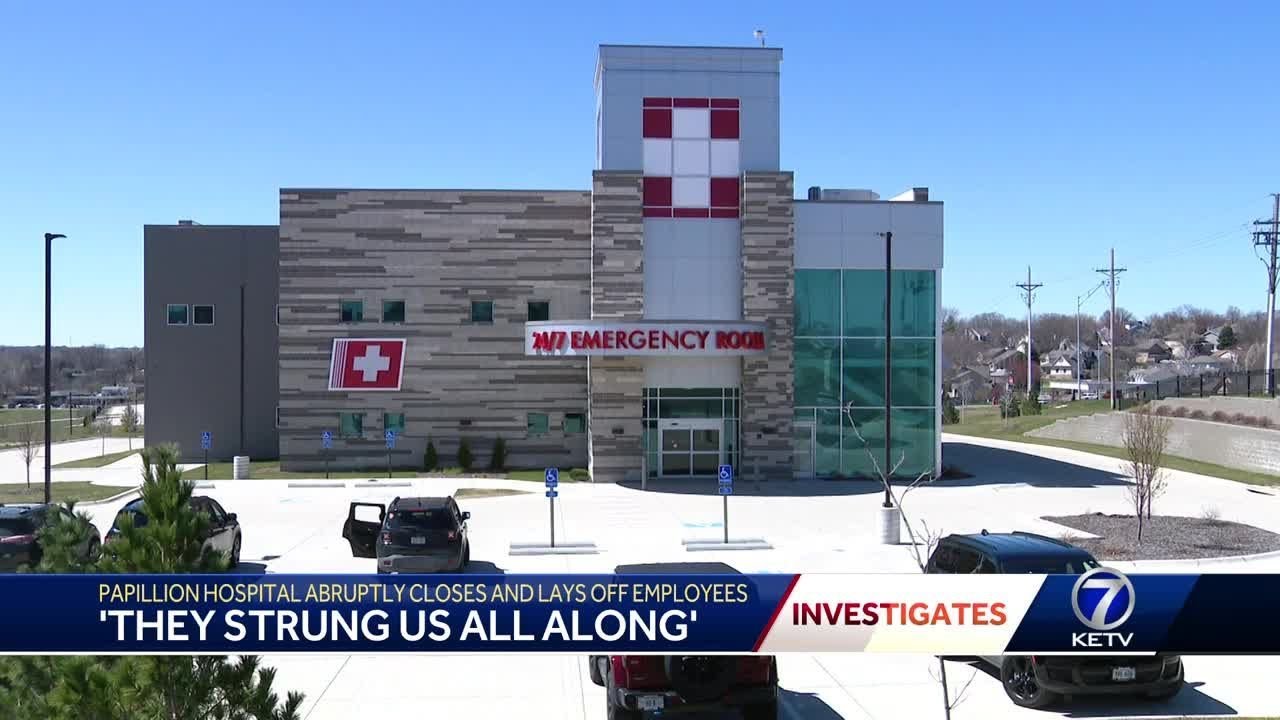

The Broader Implications for Vancouver’s Business Community

Bench Accounting’s closure will have a ripple effect on Vancouver’s business ecosystem, particularly for small and medium-sized enterprises (SMEs) that relied on the firm’s services. Similar accounting firm failures in other cities have demonstrated the potential for widespread financial disruption and erosion of trust. This incident underscores the importance of robust risk management and financial stability for all businesses.

Investor confidence in Vancouver’s business environment might be temporarily affected, although the long-term impact depends on the swift and transparent handling of the situation.

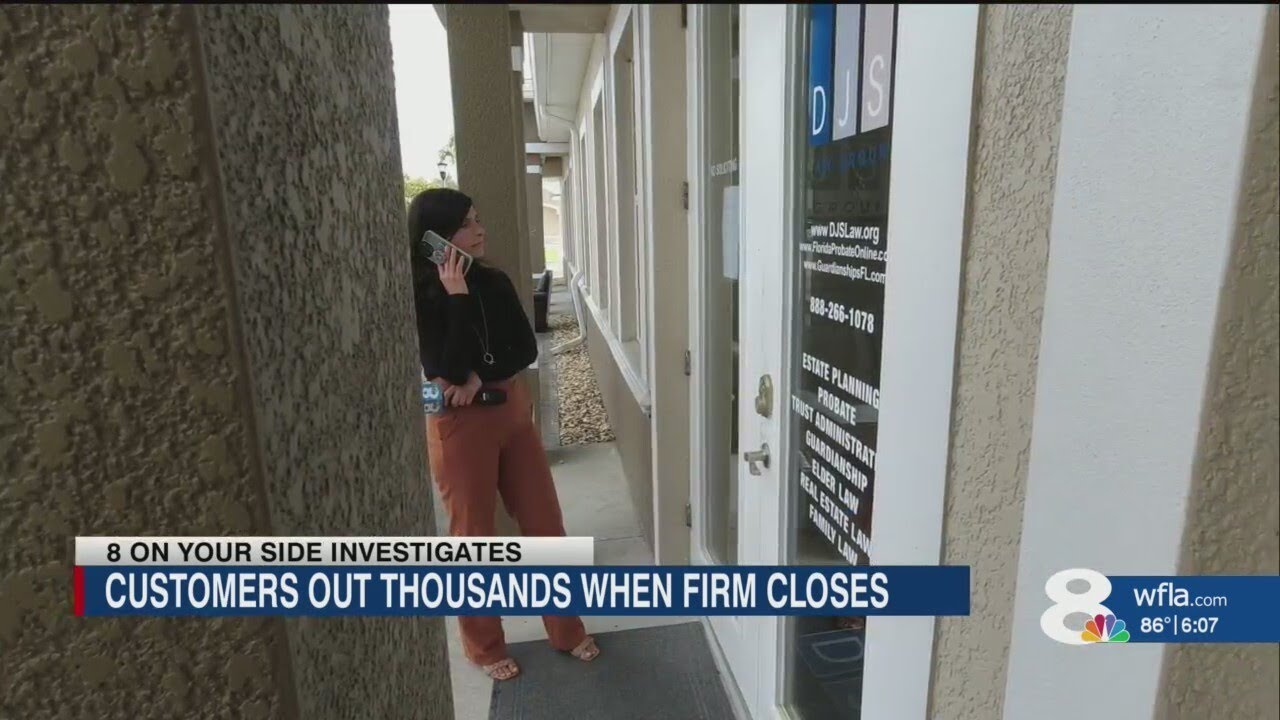

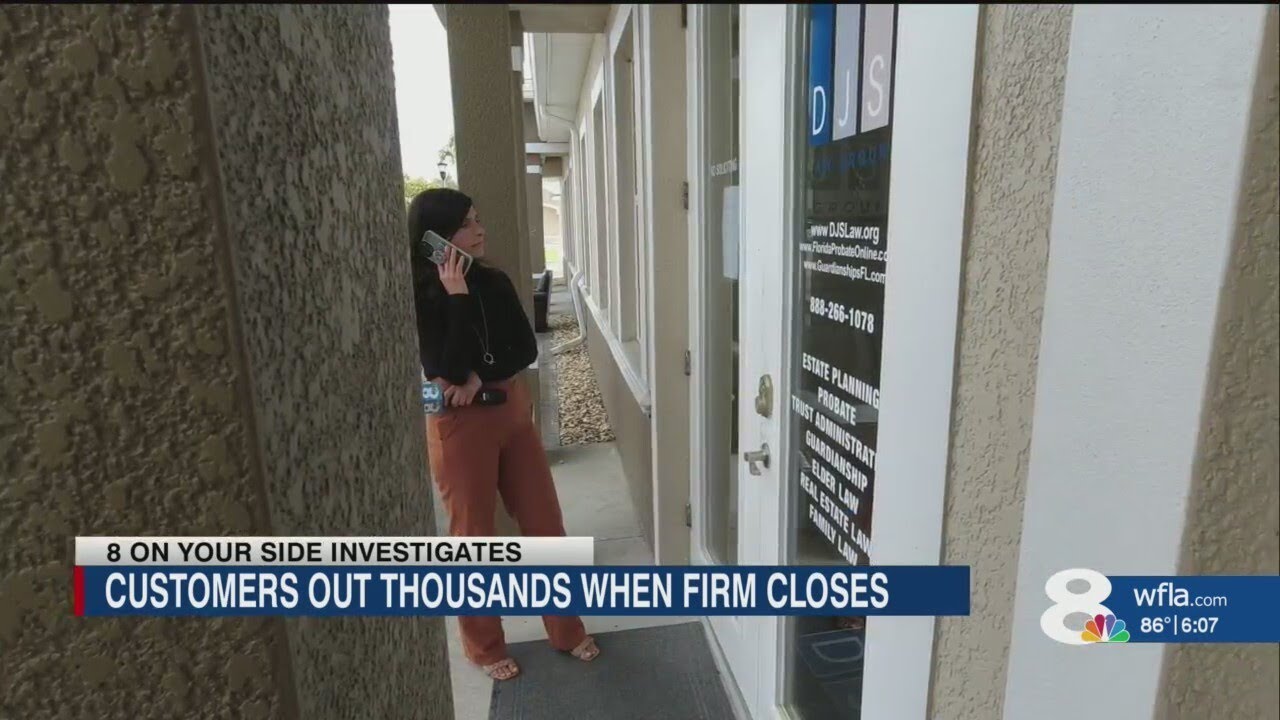

Illustrating the Situation for Public Understanding

A mid-sized accounting firm like Bench Accounting typically handles a diverse range of services, including bookkeeping, tax preparation, financial statement audits, and business consulting. The visual impact of the closure likely included empty offices, a locked storefront, and the absence of staff. The emotional impact on employees and clients was undoubtedly significant, ranging from anxiety and uncertainty to anger and frustration.

The suddenness of the closure added to the shock and emotional distress experienced by all affected parties. The silence left behind in the wake of a previously functioning business adds a poignant layer to the situation.

So, Vancouver’s Bench Accounting just went belly up, leaving a lot of folks wondering what’s next. It’s a rough situation, kind of like the Sacramento Kings’ woes, check out why they fired Mike Brown here: Struggling Kings fire third-year head coach Mike Brown – ESPN. The sudden closure of Bench Accounting, especially with the 606 connection, really highlights how quickly things can change in business.

Ending Remarks

The abrupt closure of Vancouver’s Bench Accounting, with its lingering mystery surrounding the number 606, serves as a cautionary tale for businesses of all sizes. The incident underscores the need for transparent financial practices, proactive risk management, and a keen awareness of potential economic vulnerabilities. While the immediate impact is felt by clients and employees, the long-term consequences for Vancouver’s business community remain to be seen.

This event highlights the interconnectedness of the city’s economic ecosystem and the ripple effects that can occur when a key player unexpectedly exits the market.

Detailed FAQs: Vancouver’s Bench Accounting Abruptly Shuts Down, With 606

What are the next steps for Bench Accounting’s clients?

Clients should immediately seek legal counsel to understand their options for recovering assets and information. They may also need to find a new accounting firm to manage their financial records.

What support is available for displaced employees?

Displaced employees should contact Employment Insurance (EI) and explore job search resources available through government agencies and private employment services.

What role did regulatory bodies play in this situation?

The relevant regulatory bodies will likely investigate the closure to determine if any violations occurred and to protect the interests of clients and creditors. Their involvement may lead to further legal action.

Could this happen to other accounting firms?

While this is an unusual event, all businesses face risks. This case highlights the importance of robust financial planning, risk assessment, and regulatory compliance for all firms, regardless of size.